Accidental Billionaires.

A Total Lifetime Financial Plan.

Mr. E works in a professionally rewarding (but low-paying) career doing precisely what he loves to do. He is my age and is currently worth nearly $9m thanks to several inheritances and several strokes of rapid succession good luck. His wife, J, also works full-time but would gleefully retire (as she puts it) “on any given bad day at work.” Mr. and Mrs. E own their own home and spend roughly $285,000 per year in New York City where they currently reside, but they’re in the process of moving to Florida where they will pay zero state income taxes and lower their living expenses to around $165,000 per year. On average, their total investment returns are roughly 10% per year.

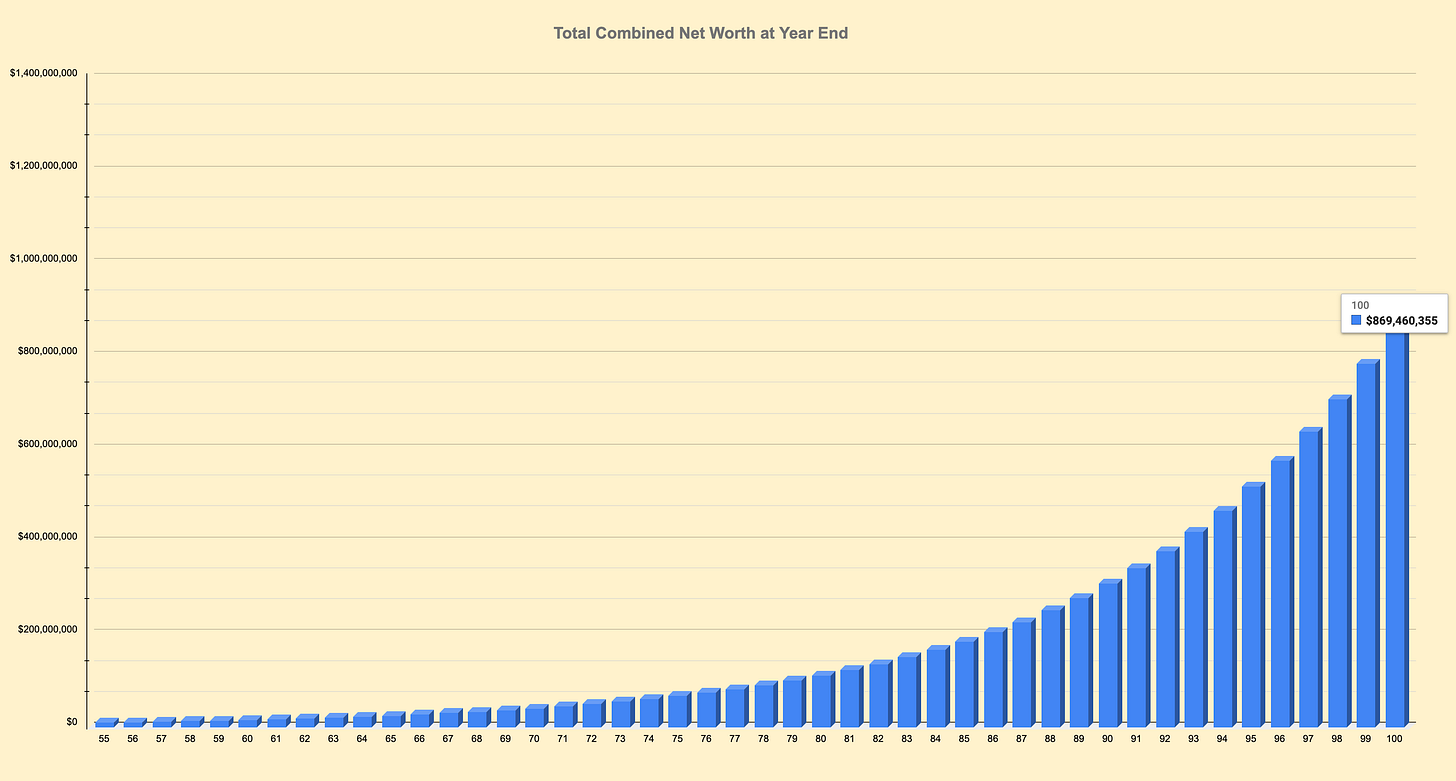

Using a spreadsheet tool that I built for them, I can calculate their Federal income taxes year-by-year and then project their future net worth assuming (1) average investment returns of 10% per year and (2) annual spending increases of 3%. How much would they be worth by age 100 under these assumptions?

Answer: a modest $869,460,355!

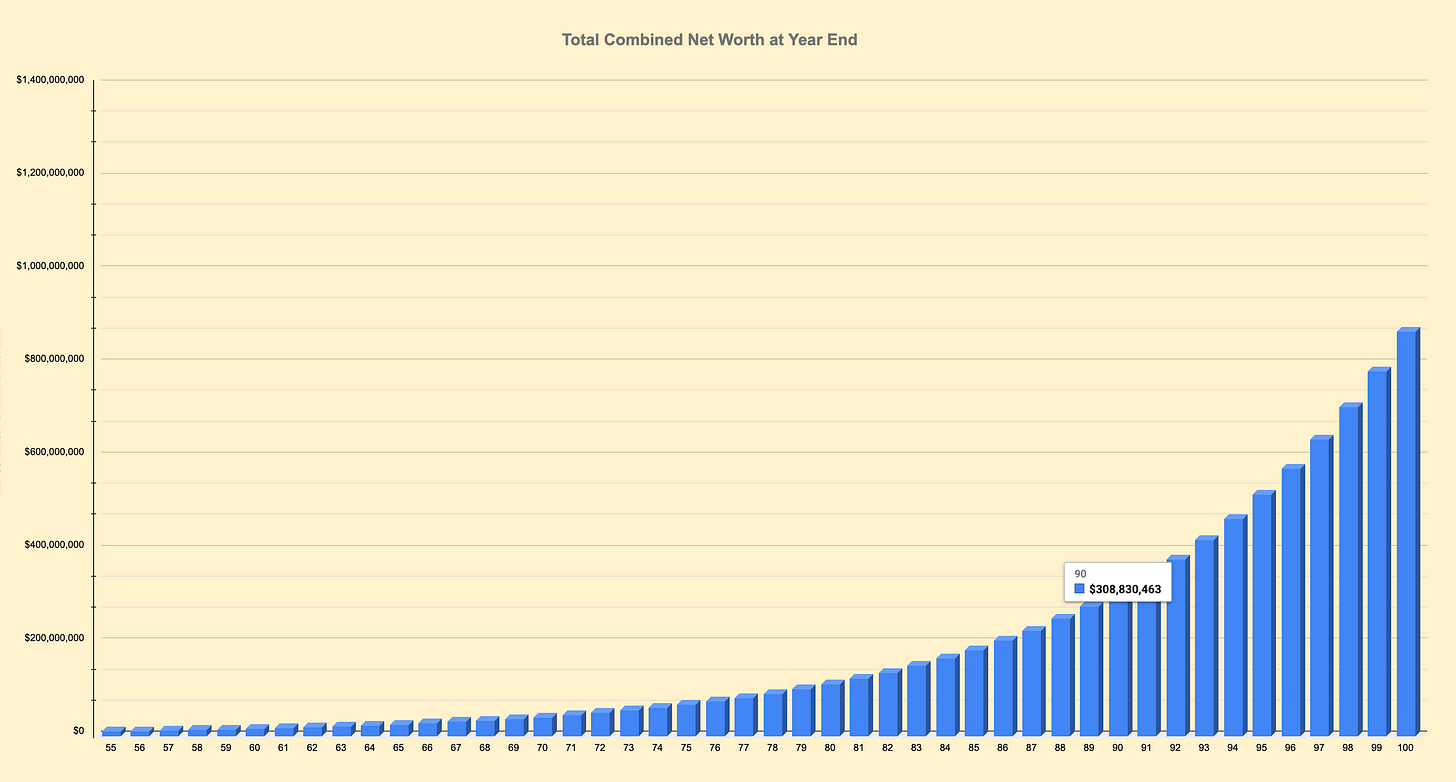

But now look at their projected net worth by age 90. It’s $308,830,463… far less than HALF their projected age 100 net worth.

The conclusion is inescapable. Like many wealthy couples, Mr. and Mrs. E stand to make far, far more money in their last 10 years than their entire preceding 90 years.

This information is not merely interesting. It is directly actionable. How?

The Only Question That Really Matters.

Isn’t it interesting how the pressing needs of today feel much more more real than the conjectures and unknowns of the distant future? That feeling is undeniably real, but that doesn’t make the feeling true in any rational sense. We humans are prone to mistrust and marginalize the unknown foreignness of the unknowable future, whereas we form an almost tribal connection to the moment now. But like all forms of bias, this one, too, is merely a choice. Making a different choice is as simple as shifting our attention from the left hand side of a chart to the right hand side.

And when do, the form of a question starts to emerge from the fog.

Something feels wrong. Because after all, if accumulating close to $1 billion was as simple as this chart makes it look, then why doesn’t everyone earn astronomical returns by age 100? What is it that gets in the way?

The answer is that all of the computations behind their chart are premised on five key mathematical assumptions. These five assumptions rarely hold true in the real world. Perhaps these five financial assumptions CANNOT hold true in the real world without a conscious and consistent choice to treat them as core priorities over an entire lifetime.

The Top Five Financial Priorities.

Priority Number Five: Mr. and Mrs. E’s chart assumes no large and permanent losses of capital. In the real world, asset prices fluctuate wildly and investments can (and often do) drop towards zero. By the same token, investment returns typically revert towards their long-term mean… but that ASSUMES the investor doesn’t get in the way! Which, of course, investors are very much prone to do. The most common failures to avoid are:

(1) Do not lock in short term losses by panic selling.

(2) Do not place yourself in a position where you may become a forced seller. For example, never use leverage on your portfolio. Do not plan expenses that require you to regularly sell stocks to raise cash. Do not write put options, call options or stock futures.

(3) Diversify to the point where if one or more of your investments goes to zero, it won’t materially impact your financial situation.

(4) Secure multiple sources of reliable passive income to meet your spending needs. That way, you can limit (or avoid altogether) any need to sell shares during a bear market to fund living expenses or emergency spending needs.

(5) Live debt-free or close to it. Income fluctuates, debt repayment obligations mostly don’t. This timing mismatch can transmogrify a fleeting moment of inconvenience into a lasting financial hellscape. Always remember that a debt-free millionaire is more financially secure than a heavily-indebted billionaire.

Priority Number Four: Mr. and Mrs. E’s financial projection assumes no sudden, large expenses. In the real world, things like medical expenses, vexatious litigation and costly home repairs routinely throw careful financial plans off track. There are no guarantees in life, but the E’s can try to mitigate risk by keeping generous emergency funds and comprehensive insurance coverage. Or, they can move to jurisdictions with state-backed healthcare coverage and limited litigation risk.

Priority Number Three: Their financial projection assumes that Mr. and Mrs. E invest savings at all times from now until age 100. For that assumption to be accurate, they should adopt a mindless and repetitious habit of reinvesting dividends regularly and irrespective of market conditions, ideas or new thinking. They should not fiddle with their money. Mr. and Mrs. E should behave towards money exactly as one would a nest of perturbed hornets - the less interaction, the better.

The financial services industry being what it is, Mr. and Mrs. E should expect invitations to invest in venture capital funds, private equity vehicles and dubious-sounding “absolute return strategies.” Their long-term chart, however, is premised entirely on low-cost, idiot-proof, passive, diversified index funds. There is no need (or perhaps even room) for more involved investments than that.

Priority Number Two: The calculations in their chart assume that even as their net worth and income grow, Mr. and Mrs. E will continue to spend as they currently do with only modest adjustments for inflation. The vast majority of people struggle to do this. We are impelled by a notion that we’re somehow “supposed” to consume more and better. “Financial freedom” means the freedom to make a different choice.

and…..

Priority Number One:

Being alive at age 100 is the MOST important assumption behind the financial projections in this exercise. Less explicitly, so too is the need to enjoy being alive. Mr. and Mrs. E will be paid tremendous sums for doing things that tend to increase their lifespan and life quality. If one hour of exercise per day increases their projected lifespan from 90 years to 100 years, their long-term financial projection shows that Mr. and Mrs. E will be paid an extra half a billion dollars.

I calculate that equals an hourly paycheck of $30,441 just for going to the gym.

There is no question whatsoever that the overwhelmingly best financial advice is to avoid unhealthy habits and stress, to exercise and get regular medical check-ups. You will be paid unimaginable sums to not smoke, use drugs or drink to excess. Engage in activities that promote your spiritual health. Get ample sleep at night. Have a purpose doing the things that you enjoy doing with people you enjoy being with. The true wonder of the power of compounding is the fact that you shall be paid exponentially larger and larger amounts for every single extra breath that you can muster.

So make the next breath a good one and then keep going.

… But One Final Question:

What’s it all for? Mr. and Mrs. E are on a path that could end with a truly monumental sum of capital. So what comes next? What’s the point?

My own bias, of course, is always maximize returns with the least risk possible but speaking with Mr. and Mrs. E has expanded my horizons. I’m shocked to learn that they actively DO NOT WANT a net worth even remotely that high! They view the outcome of this exercise without enthusiasm but rather, with unease and discomfort.

During our various conversations, it comes to light that Mr. and Mrs. E have held off on charitable giving because they weren’t convinced that they have enough to guarantee a comfortable retirement. Living in New York City can do that to you - even for high-net-worth couples like Mr. and Mrs. E. But seeing where things COULD end up by age 100 has inverted that perspective. Mr. and Mrs. E plan to start some charitable giving today to begin getting ahead of “the problem” of over-accumulating wealth in the future.

You could correctly say that Mr. and Mrs. E do not aim to maximize their financial returns per se. Instead, they have a completely different financial goal. They aim to maximize their potential for kindness and generosity towards others. They measure success in terms of “net capacity for good” instead of “net worth.”

We live in troubled times. But this? This is a bright, shining goal.